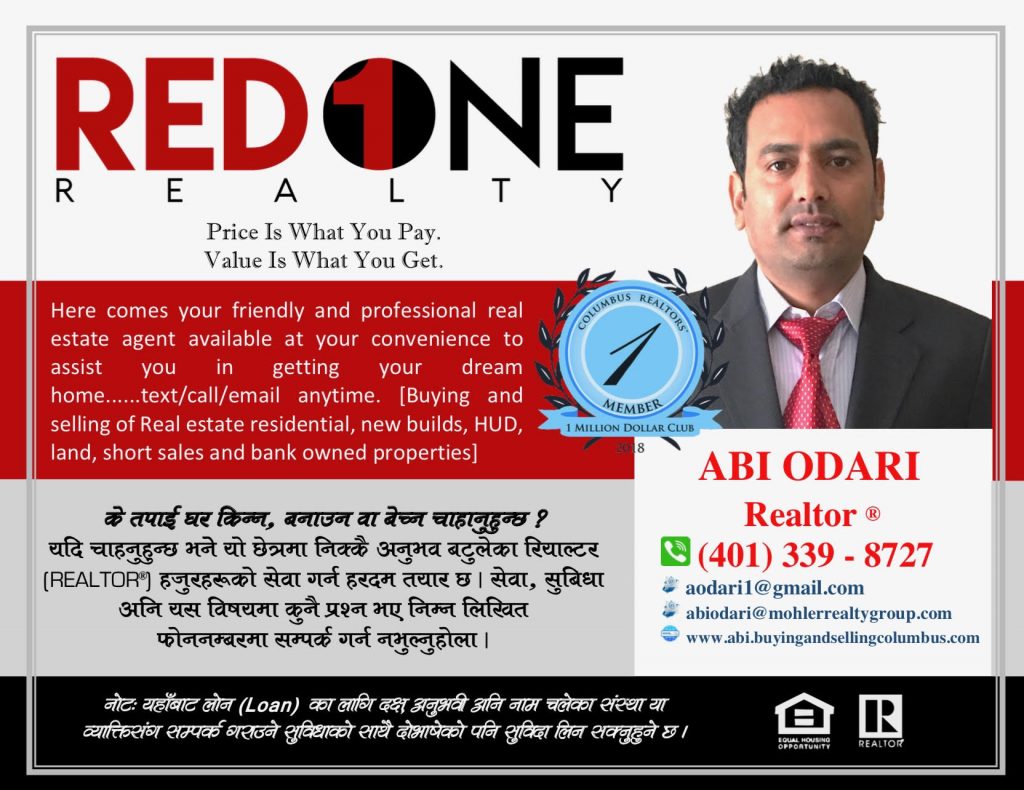

Central Ohio-based realtor Abi Odari has advised that buying a house is a way of building financial security while this pandemic period serves as the appropriate time to buy one.

“The ongoing COVID-19 pandemic has made 2021 a singular time to become a homeowner. Mortgage rates are relatively low right now. Since the interest rate can play a significant role in the loan’s total cost, snagging a mortgage while interest rates are low could be a good move,” Realtor Abi Odari told New Americans Business.

Abi, who qualified as a realtor in 2017 talked about his passion and other things he does in creating amazing customer satisfaction working as full-time real estate agent in central Ohio.

Passion

I help people purchase or sell real estate properties. I advise clients about market conditions, conduct walkthroughs, and provide guidance and assistance through the process of buying or selling properties from beginning to end.

Reasons

Buying a house is a good way to start building financial security. As you pay down the mortgage, you build up home equity which is a valuable financial resource.

- Stable Monthly Payments

- Opportunity to Build Equity

- Cheaper Than Renting Overtime

- Owning A Home Provides Tax Advantages

- Freedom to Make Changes

- Build Your Credit

- Solid Investment

- Process of buying a home

Steps

Step 1: Check Your Credit Score

Step 2: Save For A Down Payment and Closing Costs

Step 3: Determine How Much Home You Can Afford

Step 4: Choose A Lender

Step 5: Get Preapproved for A Loan

Step 6: Find the Right Real Estate Agent

Step 7: Determine Your Priorities

Step 8: Start House Hunting

Payment

A buyer does not necessarily need to pay cash to buy a house. Instead, the buyer will make a small down payment in cash (3.5 to 20% of the sale price); get a loan from a bank called a mortgage for the balance. The payment on the loan is expected every month for between 15 or 30 years.

Preparation

- Start saving early

- Decide how much home you can afford

- Check and strengthen your credit

- Explore mortgage options

- Research first-time home buyer assistance programs

- Compare mortgage rates and fees

- Get a preapproval letter

- Choose a real estate agent carefully

- Pick the right type of house and neighborhood

- Stick to your budget

- Make the most of open houses

- Pay for your home inspection

- Negotiate with sellers

- Buy an adequate home insurance.

(Abi Odari (Realtor) Email: aodari1@gmail.com Tel: 401-339-8727 of Red One Realty 929 Eastwind Drive # 206, Westerville, OH 43081)